【指南】在RAG管道中实现上下文检索

介绍

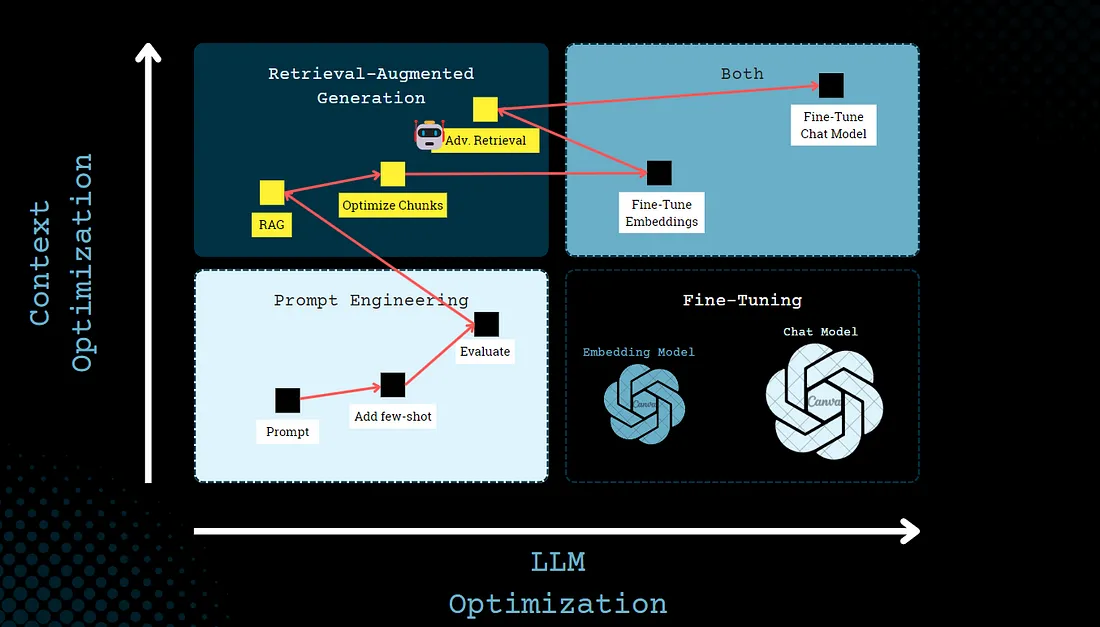

当我们谈论设计 LLM 应用程序时,我们经常使用四种主要的原型模式:

- 提示工程:在上下文中学习设计模式

- 检索增强生成:让法学硕士能够获取新知识

- 微调:训练或教导模型如何根据输入和输出采取行动

- 代理:使用 ReAct 模式增强搜索和检索过程。

如果我们的上下文少于 200,000 个标记(约 500 页材料),我们不需要 RAG 解决方案。我们可以利用更长的提示,将整个知识库包含在提示中,然后将其传递给 LLM 以生成响应。

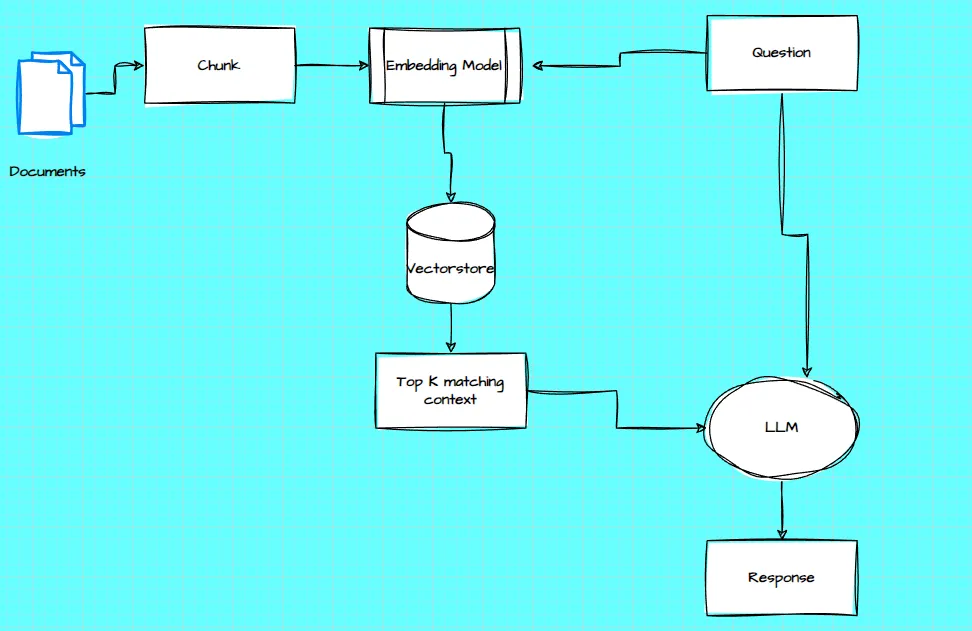

传统 RAG

对于不适合 LLM 上下文窗口的较大知识库,RAG 是典型的解决方案。RAG 通过使用以下步骤预处理知识库来工作:

- 将知识库(文档的“语料库”)分解为更小的文本块,通常不超过几百个标记;

- 使用嵌入模型将这些块转换为编码含义的向量嵌入;

- 将这些嵌入存储在允许通过语义相似性进行搜索的向量数据库中。

在运行时,当用户向 LLM 输入查询时,向量数据库会根据与查询的语义相似度来查找最相关的块。然后,将最相关的块添加到发送到 LLM 的提示中以合成响应。

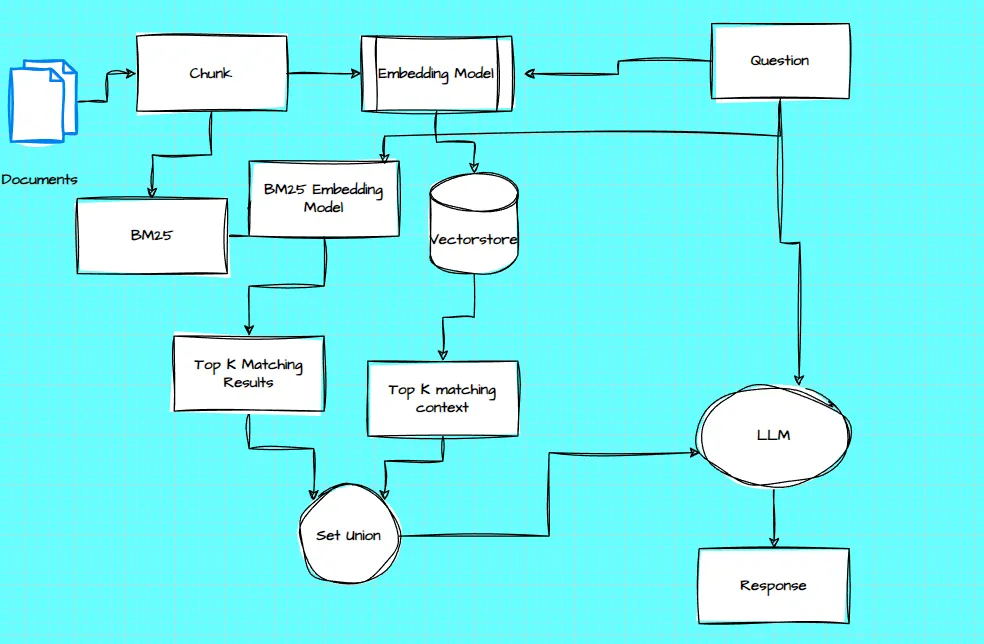

虽然嵌入模型擅长捕捉语义关系,但它们可能会错过关键的精确匹配。为了克服这一限制,人们实施了混合搜索等传统 RAG 技术。在这种方法中,语义搜索与关键词搜索相结合

高级 RAG - 混合搜索

BM25(最佳匹配 25)是一种排名函数,它使用词汇匹配来找到精确的单词或短语匹配。BM25 的工作原理是建立在 TF-IDF 概念之上。

这种方法可以让你以经济高效的方式扩展到庞大的知识库,远远超出单个提示所能容纳的范围。但当前 RAG 系统的最大问题是它丢失了大量上下文信息。

为了实现这一目的,Anthropic 提出了上下文检索技术。

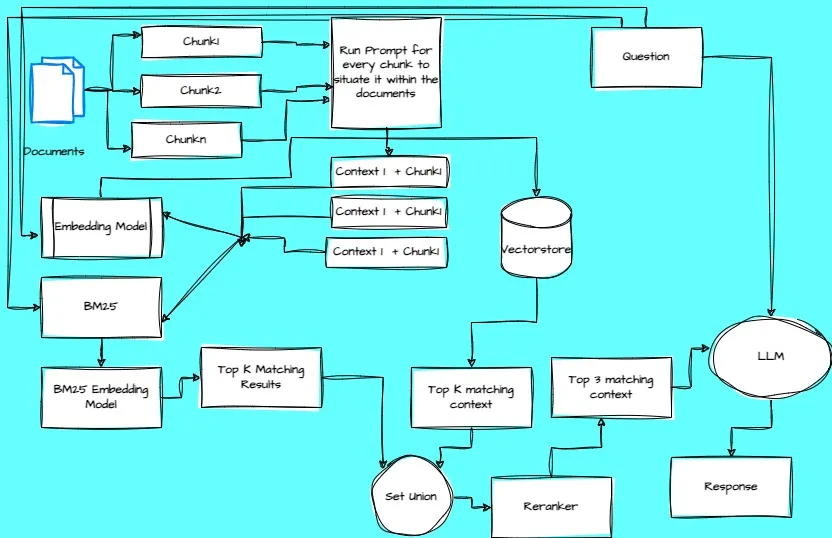

上下文检索

上下文检索通过在嵌入之前将特定于块的解释上下文添加到每个块(“上下文嵌入”)并创建 BM25 索引(“上下文 BM25”)来解决此问题。

这种上下文块添加由 LLM 实现。为了实现上下文检索,我们指示 LLM 模型提供简明的块特定上下文,使用整个文档的上下文来解释块。

Anthropic 发布的上下文块添加提示

<document>

{{WHOLE_DOCUMENT}}

</document>

Here is the chunk we want to situate within the whole document is the chunk we want to situate within the whole document

<chunk>

{{CHUNK_CONTENT}}

</chunk>

Please give a short succinct context to situate this chunk within the overall document for the purposes of improving search retrieval of the chunk. Answer only with the succinct context and nothing else.

在嵌入之前和创建 BM25 索引之前,生成的上下文通常为 50-100 个标记,被添加到块的前面

上下文检索可与重新排序技术相结合,从而进一步提高性能。重新排序是一种常用的过滤技术,可确保只有最相关的信息块才会传递给模型。重新排序可提供更好的响应,并降低成本和延迟,因为模型处理的信息更少。

上下文检索的传统问题

- 令牌开销增加: 为每个数据块添加 50 到 100 个上下文信息标记会增加总体标记数,这可能会导致处理大型数据集时的成本增加。

- LLM 处理成本: 通过像 Haiku LLM 模型这样的 LLM 来生成上下文,会增加计算开销。不过,Anthropic 提供的及时缓存功能可以减轻其中的一些成本,最多可将成本降低 90%。

- 针对特定应用的调整: 上下文检索不是一个放之四海而皆准的解决方案。我们需要根据具体的使用情况定制分块策略、嵌入模型和上下文化提示。

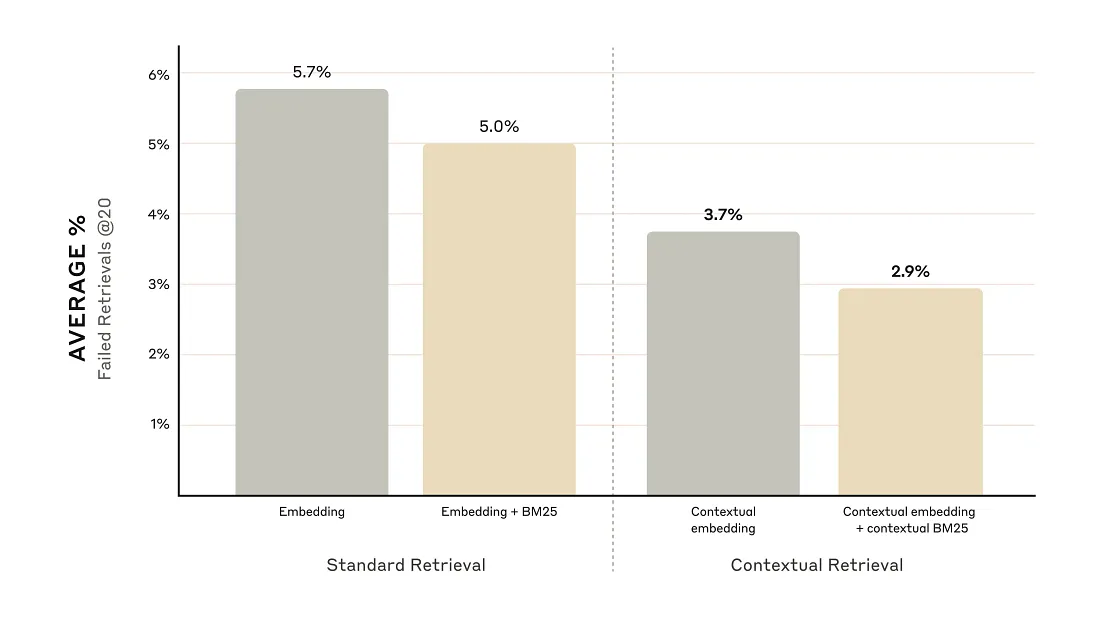

Anthropic 所展示的上下文检索性能

实施注意事项

- 分块边界: 块大小和块重叠的选择会影响检索性能

- 嵌入模型:在我们测试的所有嵌入模型中,上下文检索都能提高性能,但某些模型可能比其他模型更有优势。我们发现,Gemini 和 Voyage 嵌入尤其有效。

- 自定义上下文提示: Anthropic 提供的通用提示效果很好。但是,利用针对特定领域或用例的定制提示可以获得更好的性能。

- 块的数量: 在上下文窗口中添加更多信息块可增加包含相关信息的机会。但是,更多的信息可能会分散模型的注意力,因此这是有限度的。Anthropic 尝试了提供 5、10 和 20 个分块,发现使用 20 个分块的性能最好,但值得在特定用例中进行试验。

使用的技术栈

- 基于 llama-3.2-3b 模型的 Groq 推理作为 LLM

- Huggingface BAAI/bge-large-en-v1.5 作为嵌入模型

- 应用框架 Langchain

- 谷歌实验室(CPU)

代码实现

- 安装所需的依赖项

%pip install langchain langchain-openai openai faiss-cpu python-dotenv rank_bm25 flashrank langchain_groq groq

%pip install -qU langchain-groq

%pip install -qU langchain-community

%pip install -qU sentence-transformers

- 导入所需的依赖项

import hashlib

import os

import getpass

from typing import List, Tuple

from dotenv import load_dotenv

from langchain.text_splitter import RecursiveCharacterTextSplitter

from langchain.schema import Document

from langchain.embeddings import OpenAIEmbeddings

from langchain.vectorstores import FAISS

from langchain_openai import ChatOpenAI

from langchain_groq import ChatGroq

from langchain.prompts import ChatPromptTemplate

from rank_bm25 import BM25Okapi

from langchain.retrievers import ContextualCompressionRetriever,BM25Retriever,EnsembleRetriever

from langchain.retrievers.document_compressors import DocumentCompressorPipeline

from langchain_community.document_transformers.embeddings_redundant_filter import EmbeddingsRedundantFilter

from langchain.retrievers.document_compressors import FlashrankRerank

from langchain_community.embeddings import HuggingFaceEmbeddings

- 设置 Groq API 密钥

from google.colab import userdata

import os

os.environ["GROQ_API_KEY"] =userdata.get('GROQ_API_KEY')

- 创建 RAG 管道

class ContextualRetrieval:

"""

A class that implements the Contextual Retrieval system.

"""

def __init__(self):

"""

Initialize the ContextualRetrieval system.

"""

self.text_splitter = RecursiveCharacterTextSplitter(

chunk_size=800,

chunk_overlap=100,

)

#self.embeddings = OpenAIEmbeddings()

model_name = "BAAI/bge-large-en-v1.5"

model_kwargs = {'device': 'cpu'}

encode_kwargs = {'normalize_embeddings': False}

self.embeddings = HuggingFaceEmbeddings(

model_name=model_name,

model_kwargs=model_kwargs,

encode_kwargs=encode_kwargs

)

# self.llm = ChatOpenAI(

# model="gpt-4o",

# temperature=0,

# max_tokens=None,

# timeout=None,

# max_retries=2,

# )

self.llm = ChatGroq(

model="llama-3.2-3b-preview",

temperature=0,

max_tokens=None,

timeout=None,

max_retries=2,

)

def process_document(self, document: str) -> Tuple[List[Document], List[Document]]:

"""

Process a document by splitting it into chunks and generating context for each chunk.

"""

chunks = self.text_splitter.create_documents([document])

contextualized_chunks = self._generate_contextualized_chunks(document, chunks)

return chunks, contextualized_chunks

def _generate_contextualized_chunks(self, document: str, chunks: List[Document]) -> List[Document]:

"""

Generate contextualized versions of the given chunks.

"""

contextualized_chunks = []

for chunk in chunks:

context = self._generate_context(document, chunk.page_content)

contextualized_content = f"{context}\n\n{chunk.page_content}"

contextualized_chunks.append(Document(page_content=contextualized_content, metadata=chunk.metadata))

return contextualized_chunks

def _generate_context(self, document: str, chunk: str) -> str:

"""

Generate context for a specific chunk using the language model.

"""

prompt = ChatPromptTemplate.from_template("""

You are an AI assistant specializing in financial analysis, particularly for Tesla, Inc. Your task is to provide brief, relevant context for a chunk of text from Tesla's Q3 2023 financial report.

Here is the financial report:

<document>

{document}

</document>

Here is the chunk we want to situate within the whole document::

<chunk>

{chunk}

</chunk>

Provide a concise context (2-3 sentences) for this chunk, considering the following guidelines:

1. Identify the main financial topic or metric discussed (e.g., revenue, profitability, segment performance, market position).

2. Mention any relevant time periods or comparisons (e.g., Q3 2023, year-over-year changes).

3. If applicable, note how this information relates to Tesla's overall financial health, strategy, or market position.

4. Include any key figures or percentages that provide important context.

5. Do not use phrases like "This chunk discusses" or "This section provides". Instead, directly state the context.

Please give a short succinct context to situate this chunk within the overall document for the purposes of improving search retrieval of the chunk. Answer only with the succinct context and nothing else.

Context:

""")

messages = prompt.format_messages(document=document, chunk=chunk)

response = self.llm.invoke(messages)

return response.content

def create_vectorstores(self, chunks: List[Document]) -> FAISS:

"""

Create a vector store for the given chunks.

"""

return FAISS.from_documents(chunks, self.embeddings)

def create_bm25_index(self, chunks: List[Document]) -> BM25Okapi:

"""

Create a BM25 index for the given chunks.

"""

tokenized_chunks = [chunk.page_content.split() for chunk in chunks]

return BM25Okapi(tokenized_chunks)

def create_flashrank_index(self,vectorstore):

"""

Create a FlashRank index for the given chunks.

"""

retriever = vectorstore.as_retriever(search_kwargs={"k":20})

compression_retriever = ContextualCompressionRetriever(base_compressor=FlashrankRerank(), base_retriever=retriever)

return compression_retriever

def create_bm25_retriever(self, chunks: List[Document]) -> BM25Retriever:

"""

Create a BM25 retriever for the given chunks.

"""

bm25_retriever = BM25Retriever.from_documents(chunks)

return bm25_retriever

def create_ensemble_retriever_reranker(self, vectorstore, bm25_retriever) -> EnsembleRetriever:

"""

Create an ensemble retriever for the given chunks.

"""

retriever_vs = vectorstore.as_retriever(search_kwargs={"k":20})

bm25_retriever.k =10

ensemble_retriever = EnsembleRetriever(

retrievers=[retriever_vs, bm25_retriever],

weights=[0.5, 0.5]

)

redundant_filter = EmbeddingsRedundantFilter(embeddings=self.embeddings)

#

reranker = FlashrankRerank()

pipeline_compressor = DocumentCompressorPipeline(transformers=[redundant_filter, reranker])

#

compression_pipeline = ContextualCompressionRetriever(base_compressor=pipeline_compressor,

base_retriever=ensemble_retriever)

return compression_pipeline

@staticmethod

def generate_cache_key(document: str) -> str:

"""

Generate a cache key for a document.

"""

return hashlib.md5(document.encode()).hexdigest()

def generate_answer(self, query: str, relevant_chunks: List[str]) -> str:

prompt = ChatPromptTemplate.from_template("""

Based on the following information, please provide a concise and accurate answer to the question.

If the information is not sufficient to answer the question, say so.

Question: {query}

Relevant information:

{chunks}

Answer:

""")

messages = prompt.format_messages(query=query, chunks="\n\n".join(relevant_chunks))

response = self.llm.invoke(messages)

return response.content

- 不满足的 RAG 管道

cr = ContextualRetrieval()

- 样本文件

# Example financial document (approximately 5000 words, keyword-rich)

document = """

Tesla, Inc. (TSLA) Financial Analysis and Market Overview - Q3 2023

Executive Summary:

Tesla, Inc. (NASDAQ: TSLA) continues to lead the electric vehicle (EV) market, showcasing strong financial performance and strategic growth initiatives in Q3 2023. This comprehensive analysis delves into Tesla's financial statements, market position, and future outlook, providing investors and stakeholders with crucial insights into the company's performance and potential.

1. Financial Performance Overview:

Revenue:

Tesla reported total revenue of $23.35 billion in Q3 2023, marking a 9% increase year-over-year (YoY) from $21.45 billion in Q3 2022. The automotive segment remained the primary revenue driver, contributing $19.63 billion, up 5% YoY. Energy generation and storage revenue saw significant growth, reaching $1.56 billion, a 40% increase YoY.

Profitability:

Gross profit for Q3 2023 stood at $4.18 billion, with a gross margin of 17.9%. While this represents a decrease from the 25.1% gross margin in Q3 2022, it remains above industry averages. Operating income was $1.76 billion, resulting in an operating margin of 7.6%. Net income attributable to common stockholders was $1.85 billion, translating to diluted earnings per share (EPS) of $0.53.

Cash Flow and Liquidity:

Tesla's cash and cash equivalents at the end of Q3 2023 were $26.08 billion, a robust position that provides ample liquidity for ongoing operations and future investments. Free cash flow for the quarter was $0.85 billion, reflecting the company's ability to generate cash despite significant capital expenditures.

2. Operational Highlights:

Production and Deliveries:

Tesla produced 430,488 vehicles in Q3 2023, a 17% increase YoY. The Model 3/Y accounted for 419,666 units, while the Model S/X contributed 10,822 units. Total deliveries reached 435,059 vehicles, up 27% YoY, demonstrating strong demand and improved production efficiency.

Manufacturing Capacity:

The company's installed annual vehicle production capacity increased to over 2 million units across its factories in Fremont, Shanghai, Berlin-Brandenburg, and Texas. The Shanghai Gigafactory remains the highest-volume plant, with an annual capacity exceeding 950,000 units.

Energy Business:

Tesla's energy storage deployments grew by 90% YoY, reaching 4.0 GWh in Q3 2023. Solar deployments also increased by 48% YoY to 106 MW, reflecting growing demand for Tesla's energy products.

3. Market Position and Competitive Landscape:

Global EV Market Share:

Tesla maintained its position as the world's largest EV manufacturer by volume, with an estimated global market share of 18% in Q3 2023. However, competition is intensifying, particularly from Chinese manufacturers like BYD and established automakers accelerating their EV strategies.

Brand Strength:

Tesla's brand value continues to grow, ranked as the 12th most valuable brand globally by Interbrand in 2023, with an estimated brand value of $56.3 billion, up 4% from 2022.

Technology Leadership:

The company's focus on innovation, particularly in battery technology and autonomous driving capabilities, remains a key differentiator. Tesla's Full Self-Driving (FSD) beta program has expanded to over 800,000 customers in North America, showcasing its advanced driver assistance systems.

4. Strategic Initiatives and Future Outlook:

Product Roadmap:

Tesla reaffirmed its commitment to launching the Cybertruck in 2023, with initial deliveries expected in Q4. The company also hinted at progress on a next-generation vehicle platform, aimed at significantly reducing production costs.

Expansion Plans:

Plans for a new Gigafactory in Mexico are progressing, with production expected to commence in 2025. This facility will focus on producing Tesla's next-generation vehicles and expand the company's North American manufacturing footprint.

Battery Production:

Tesla continues to ramp up its in-house battery cell production, with 4680 cells now being used in Model Y vehicles produced at the Texas Gigafactory. The company aims to achieve an annual production rate of 1,000 GWh by 2030.

5. Risk Factors and Challenges:

Supply Chain Constraints:

While easing compared to previous years, supply chain issues continue to pose challenges, particularly in sourcing semiconductor chips and raw materials for batteries.

Regulatory Environment:

Evolving regulations around EVs, autonomous driving, and data privacy across different markets could impact Tesla's operations and expansion plans.

Macroeconomic Factors:

Rising interest rates and inflationary pressures may affect consumer demand for EVs and impact Tesla's profit margins.

Competition:

Intensifying competition in the EV market, especially in key markets like China and Europe, could pressure Tesla's market share and pricing power.

6. Financial Ratios and Metrics:

Profitability Ratios:

- Return on Equity (ROE): 18.2%

- Return on Assets (ROA): 10.3%

- EBITDA Margin: 15.7%

Liquidity Ratios:

- Current Ratio: 1.73

- Quick Ratio: 1.25

Efficiency Ratios:

- Asset Turnover Ratio: 0.88

- Inventory Turnover Ratio: 11.2

Valuation Metrics:

- Price-to-Earnings (P/E) Ratio: 70.5

- Price-to-Sales (P/S) Ratio: 7.8

- Enterprise Value to EBITDA (EV/EBITDA): 41.2

7. Segment Analysis:

Automotive Segment:

- Revenue: $19.63 billion (84% of total revenue)

- Gross Margin: 18.9%

- Key Products: Model 3, Model Y, Model S, Model X

Energy Generation and Storage:

- Revenue: $1.56 billion (7% of total revenue)

- Gross Margin: 14.2%

- Key Products: Powerwall, Powerpack, Megapack, Solar Roof

Services and Other:

- Revenue: $2.16 billion (9% of total revenue)

- Gross Margin: 5.3%

- Includes vehicle maintenance, repair, and used vehicle sales

8. Geographic Revenue Distribution:

- United States: $12.34 billion (53% of total revenue)

- China: $4.67 billion (20% of total revenue)

- Europe: $3.97 billion (17% of total revenue)

- Other: $2.37 billion (10% of total revenue)

9. Research and Development:

Tesla invested $1.16 billion in R&D during Q3 2023, representing 5% of total revenue. Key focus areas include:

- Next-generation vehicle platform development

- Advancements in battery technology and production processes

- Enhancements to Full Self-Driving (FSD) capabilities

- Energy storage and solar technology improvements

10. Capital Expenditures and Investments:

Capital expenditures for Q3 2023 totaled $2.46 billion, primarily allocated to:

- Expansion and upgrades of production facilities

- Tooling for new products, including the Cybertruck

- Supercharger network expansion

- Investments in battery cell production capacity

11. Debt and Capital Structure:

As of September 30, 2023:

- Total Debt: $5.62 billion

- Total Equity: $43.51 billion

- Debt-to-Equity Ratio: 0.13

- Weighted Average Cost of Capital (WACC): 8.7%

12. Stock Performance and Shareholder Returns:

- 52-Week Price Range: $152.37 - $299.29

- Market Capitalization: $792.5 billion (as of October 31, 2023)

- Dividend Policy: Tesla does not currently pay dividends, reinvesting profits into growth initiatives

- Share Repurchases: No significant share repurchases in Q3 2023

13. Corporate Governance and Sustainability:

Board Composition:

Tesla's Board of Directors consists of 8 members, with 6 independent directors. The roles of CEO and Chairman are separate, with Robyn Denholm serving as Chairwoman.

ESG Initiatives:

- Environmental: Committed to using 100% renewable energy in all operations by 2030

- Social: Focus on diversity and inclusion, with women representing 29% of the global workforce

- Governance: Enhanced transparency in supply chain management and ethical sourcing of materials

14. Analyst Recommendations and Price Targets:

As of October 31, 2023:

- Buy: 22 analysts

- Hold: 15 analysts

- Sell: 5 analysts

- Average 12-month price target: $245.67

15. Upcoming Catalysts and Events:

- Cybertruck production ramp-up and initial deliveries (Q4 2023)

- Investor Day 2024 (Date TBA)

- Potential unveiling of next-generation vehicle platform (2024)

- Expansion of FSD beta program to additional markets

Conclusion:

Tesla's Q3 2023 financial results demonstrate the company's continued leadership in the EV market, with strong revenue growth and operational improvements. While facing increased competition and margin pressures, Tesla's robust balance sheet, technological innovations, and expanding product portfolio position it well for future growth. Investors should monitor key metrics such as production ramp-up, margin trends, and progress on strategic initiatives to assess Tesla's long-term value proposition in the rapidly evolving automotive and energy markets.

"""

- 处理文件

original_chunks, contextualized_chunks = cr.process_document(document)

print(len(contextualized_chunks))

print(original_chunks[0])

print(contextualized_chunks[0])

#################Response##############################################

15

#original_chunks

page_content='Tesla, Inc. (TSLA) Financial Analysis and Market Overview - Q3 2023

Executive Summary:

Tesla, Inc. (NASDAQ: TSLA) continues to lead the electric vehicle (EV) market, showcasing strong financial performance and strategic growth initiatives in Q3 2023. This comprehensive analysis delves into Tesla's financial statements, market position, and future outlook, providing investors and stakeholders with crucial insights into the company's performance and potential.

1. Financial Performance Overview:'

#contextualized_chunks

page_content='Tesla's Q3 2023 financial performance overview, which includes a 9% year-over-year increase in revenue to $23.35 billion, driven by strong growth in the automotive segment and significant increases in energy generation and storage revenue. The company's gross profit and operating income also show improvement, with a 17.9% gross margin and a 7.6% operating margin, respectively. These metrics highlight Tesla's continued financial strength and operational efficiency.

Tesla, Inc. (TSLA) Financial Analysis and Market Overview - Q3 2023

Executive Summary:

Tesla, Inc. (NASDAQ: TSLA) continues to lead the electric vehicle (EV) market, showcasing strong financial performance and strategic growth initiatives in Q3 2023. This comprehensive analysis delves into Tesla's financial statements, market position, and future outlook, providing investors and stakeholders with crucial insights into the company's performance and potential.

1. Financial Performance Overview:'

print(original_chunks[10])

###################################################

page_content='9. Research and Development:

Tesla invested $1.16 billion in R&D during Q3 2023, representing 5% of total revenue. Key focus areas include:

- Next-generation vehicle platform development

- Advancements in battery technology and production processes

- Enhancements to Full Self-Driving (FSD) capabilities

- Energy storage and solar technology improvements

10. Capital Expenditures and Investments:

Capital expenditures for Q3 2023 totaled $2.46 billion, primarily allocated to:

- Expansion and upgrades of production facilities

- Tooling for new products, including the Cybertruck

- Supercharger network expansion

- Investments in battery cell production capacity

11. Debt and Capital Structure:'

print(contextualized_chunks[10])

############################################################

page_content='Tesla's research and development investments and capital expenditures are crucial for the company's future growth, with a focus on next-generation vehicle platforms, battery technology advancements, and Full Self-Driving capabilities. These efforts are part of Tesla's overall strategy to improve operational efficiency and expand its product portfolio, with significant investments in Q3 2023 totaling $3.62 billion. This represents a 5% allocation of total revenue and highlights Tesla's commitment to innovation and technological advancements.

9. Research and Development:

Tesla invested $1.16 billion in R&D during Q3 2023, representing 5% of total revenue. Key focus areas include:

- Next-generation vehicle platform development

- Advancements in battery technology and production processes

- Enhancements to Full Self-Driving (FSD) capabilities

- Energy storage and solar technology improvements

10. Capital Expenditures and Investments:

Capital expenditures for Q3 2023 totaled $2.46 billion, primarily allocated to:

- Expansion and upgrades of production facilities

- Tooling for new products, including the Cybertruck

- Supercharger network expansion

- Investments in battery cell production capacity

11. Debt and Capital Structure:'

- 创建向量存储

original_vectorstore = cr.create_vectorstores(original_chunks)

contextualized_vectorstore = cr.create_vectorstores(contextualized_chunks)

- 创建 BM25 索引

original_bm25_index = cr.create_bm25_index(original_chunks)

contextualized_bm25_index = cr.create_bm25_index(contextualized_chunks)

- 创建 Reranker

original_reranker = cr.create_flashrank_index(original_vectorstore)

contextualized_reranker = cr.create_flashrank_index(contextualized_vectorstore)

- 从Reranker中检索匹配上下文

contextualized_reranker.invoke("What was Tesla's total revenue in Q3 2023? what was the gross profit and cash position?")

#################################################################

[Document(metadata={'id': 3, 'relevance_score': 0.9995201}, page_content="Tesla's financial performance and market position are evaluated through various metrics, including profitability ratios, liquidity ratios, and efficiency ratios, which provide insights into the company's financial health and strategic direction. The Q3 2023 financial report highlights year-over-year changes in revenue, gross margin, and operating income, with a focus on the automotive segment and energy generation and storage business. Key figures include a 9% increase in revenue, a 17.9% gross margin, and an operating margin of 7.6%.\n\nRegulatory Environment:\n Evolving regulations around EVs, autonomous driving, and data privacy across different markets could impact Tesla's operations and expansion plans.\n\n Macroeconomic Factors:\n Rising interest rates and inflationary pressures may affect consumer demand for EVs and impact Tesla's profit margins.\n\n Competition:\n Intensifying competition in the EV market, especially in key markets like China and Europe, could pressure Tesla's market share and pricing power.\n\n 6. Financial Ratios and Metrics:\n\n Profitability Ratios:\n - Return on Equity (ROE): 18.2%\n - Return on Assets (ROA): 10.3%\n - EBITDA Margin: 15.7%\n\n Liquidity Ratios:\n - Current Ratio: 1.73\n - Quick Ratio: 1.25"),

Document(metadata={'id': 1, 'relevance_score': 0.99947655}, page_content="Tesla's Q3 2023 financial performance overview, which includes a 9% year-over-year increase in revenue to $23.35 billion, driven by strong growth in the automotive segment and significant increases in energy generation and storage revenue. The company's gross profit and operating income also show improvement, with a 17.9% gross margin and a 7.6% operating margin, respectively. These metrics highlight Tesla's continued financial strength and operational efficiency.\n\nTesla, Inc. (TSLA) Financial Analysis and Market Overview - Q3 2023\n\n Executive Summary:\n Tesla, Inc. (NASDAQ: TSLA) continues to lead the electric vehicle (EV) market, showcasing strong financial performance and strategic growth initiatives in Q3 2023. This comprehensive analysis delves into Tesla's financial statements, market position, and future outlook, providing investors and stakeholders with crucial insights into the company's performance and potential.\n\n 1. Financial Performance Overview:"),

Document(metadata={'id': 0, 'relevance_score': 0.99941415}, page_content="Tesla's Q3 2023 financial performance, specifically its profitability, cash flow, and liquidity, demonstrate the company's ability to maintain a strong financial position despite increased competition and margin pressures. The results show a decrease in gross margin from Q3 2022 but still above industry averages, with operating income and net income attributable to common stockholders also increasing. Key figures include a gross profit of $4.18 billion, a gross margin of 17.9%, and free cash flow of $0.85 billion.\n\nProfitability:\n Gross profit for Q3 2023 stood at $4.18 billion, with a gross margin of 17.9%. While this represents a decrease from the 25.1% gross margin in Q3 2022, it remains above industry averages. Operating income was $1.76 billion, resulting in an operating margin of 7.6%. Net income attributable to common stockholders was $1.85 billion, translating to diluted earnings per share (EPS) of $0.53.\n\n Cash Flow and Liquidity:\n Tesla's cash and cash equivalents at the end of Q3 2023 were $26.08 billion, a robust position that provides ample liquidity for ongoing operations and future investments. Free cash flow for the quarter was $0.85 billion, reflecting the company's ability to generate cash despite significant capital expenditures.\n\n 2. Operational Highlights:")]- 利用 Reranker 混合搜索创建检索系统

# Crete ensemble retriver reranker

bm25_retriever_original = cr.create_bm25_retriever(original_chunks)

#

bm25_retriever_contextualized = cr.create_bm25_retriever(contextualized_chunks)

#

original_ensemble_retriever_reranker = cr.create_ensemble_retriever_reranker(original_vectorstore, bm25_retriever_original)

#

contextualized_ensemble_retriever_reranker = cr.create_ensemble_retriever_reranker(contextualized_vectorstore, bm25_retriever_contextualized)

- 从混合检索器检索上下文

contextualized_ensemble_retriever_reranker.invoke("What was Tesla's total revenue in Q3 2023? what was the gross profit and cash position?")

#######################################################################

[Document(metadata={'id': 2, 'relevance_score': 0.9995201}, page_content="Tesla's financial performance and market position are evaluated through various metrics, including profitability ratios, liquidity ratios, and efficiency ratios, which provide insights into the company's financial health and strategic direction. The Q3 2023 financial report highlights year-over-year changes in revenue, gross margin, and operating income, with a focus on the automotive segment and energy generation and storage business. Key figures include a 9% increase in revenue, a 17.9% gross margin, and an operating margin of 7.6%.\n\nRegulatory Environment:\n Evolving regulations around EVs, autonomous driving, and data privacy across different markets could impact Tesla's operations and expansion plans.\n\n Macroeconomic Factors:\n Rising interest rates and inflationary pressures may affect consumer demand for EVs and impact Tesla's profit margins.\n\n Competition:\n Intensifying competition in the EV market, especially in key markets like China and Europe, could pressure Tesla's market share and pricing power.\n\n 6. Financial Ratios and Metrics:\n\n Profitability Ratios:\n - Return on Equity (ROE): 18.2%\n - Return on Assets (ROA): 10.3%\n - EBITDA Margin: 15.7%\n\n Liquidity Ratios:\n - Current Ratio: 1.73\n - Quick Ratio: 1.25"),

Document(metadata={'id': 1, 'relevance_score': 0.99947655}, page_content="Tesla's Q3 2023 financial performance overview, which includes a 9% year-over-year increase in revenue to $23.35 billion, driven by strong growth in the automotive segment and significant increases in energy generation and storage revenue. The company's gross profit and operating income also show improvement, with a 17.9% gross margin and a 7.6% operating margin, respectively. These metrics highlight Tesla's continued financial strength and operational efficiency.\n\nTesla, Inc. (TSLA) Financial Analysis and Market Overview - Q3 2023\n\n Executive Summary:\n Tesla, Inc. (NASDAQ: TSLA) continues to lead the electric vehicle (EV) market, showcasing strong financial performance and strategic growth initiatives in Q3 2023. This comprehensive analysis delves into Tesla's financial statements, market position, and future outlook, providing investors and stakeholders with crucial insights into the company's performance and potential.\n\n 1. Financial Performance Overview:"),

Document(metadata={'id': 0, 'relevance_score': 0.99941415}, page_content="Tesla's Q3 2023 financial performance, specifically its profitability, cash flow, and liquidity, demonstrate the company's ability to maintain a strong financial position despite increased competition and margin pressures. The results show a decrease in gross margin from Q3 2022 but still above industry averages, with operating income and net income attributable to common stockholders also increasing. Key figures include a gross profit of $4.18 billion, a gross margin of 17.9%, and free cash flow of $0.85 billion.\n\nProfitability:\n Gross profit for Q3 2023 stood at $4.18 billion, with a gross margin of 17.9%. While this represents a decrease from the 25.1% gross margin in Q3 2022, it remains above industry averages. Operating income was $1.76 billion, resulting in an operating margin of 7.6%. Net income attributable to common stockholders was $1.85 billion, translating to diluted earnings per share (EPS) of $0.53.\n\n Cash Flow and Liquidity:\n Tesla's cash and cash equivalents at the end of Q3 2023 were $26.08 billion, a robust position that provides ample liquidity for ongoing operations and future investments. Free cash flow for the quarter was $0.85 billion, reflecting the company's ability to generate cash despite significant capital expenditures.\n\n 2. Operational Highlights:")]- 为文件生成缓存密钥

cache_key = cr.generate_cache_key(document)

#

print(f"Processed {len(original_chunks)} chunks")

print(f"Cache key for the document: {cache_key}")

#

###############################################################

Processed 15 chunks

Cache key for the document: 8bc3e18738fe5e65f23ecc719972feb8

- 提问

# Example queries related to financial information

queries = [

"What was Tesla's total revenue in Q3 2023? what was the gross profit and cash position?",

"How does the automotive gross margin in Q3 2023 compare to the previous year?",

"What is Tesla's current debt-to-equity ratio?",

"How much did Tesla invest in R&D during Q3 2023?",

"What is Tesla's market share in the global EV market for Q3 2023?"

]

#

######################################################

for query in queries:

print(f"\nQuery: {query}")

# Retrieve from original vectorstore

original_vector_results = original_vectorstore.similarity_search(query, k=3)

# Retrieve from contextualized vectorstore

contextualized_vector_results = contextualized_vectorstore.similarity_search(query, k=3)

# Retrieve from original BM25

original_tokenized_query = query.split()

original_bm25_results = original_bm25_index.get_top_n(original_tokenized_query, original_chunks, n=3)

# Retrieve from contextualized BM25

contextualized_tokenized_query = query.split()

contextualized_bm25_results = contextualized_bm25_index.get_top_n(contextualized_tokenized_query, contextualized_chunks, n=3)

# Retrieve from Original Reranker

original_reranker_results = original_reranker.invoke(query)

# Retrieve from Contextualized Reranker

contextualized_reranker_results = contextualized_reranker.invoke(query)

# Retrieve from Original ensemble_retriever_reranker

original_ensemble_retriever_reranker_results = original_ensemble_retriever_reranker.invoke(query)

# Retrieve from Contextualized ensemble_retriever_reranker

contextualized_ensemble_retriever_reranker_results = contextualized_ensemble_retriever_reranker.invoke(query)

# Generate answers

original_vector_answer = cr.generate_answer(query, [doc.page_content for doc in original_vector_results])

contextualized_vector_answer = cr.generate_answer(query, [doc.page_content for doc in contextualized_vector_results])

original_bm25_answer = cr.generate_answer(query, [doc.page_content for doc in original_bm25_results])

contextualized_bm25_answer = cr.generate_answer(query, [doc.page_content for doc in contextualized_bm25_results])

original_reranker_answer = cr.generate_answer(query, [doc.page_content for doc in original_reranker_results])

contextualized_reranker_answer = cr.generate_answer(query, [doc.page_content for doc in contextualized_reranker_results])

original_ensemble_retriever_reranker_answer = cr.generate_answer(query, [doc.page_content for doc in original_ensemble_retriever_reranker_results])

contextualized_ensemble_retriever_reranker_answer = cr.generate_answer(query, [doc.page_content for doc in contextualized_ensemble_retriever_reranker_results])

print("\nOriginal Vector Search Results:")

for i, doc in enumerate(original_vector_results, 1):

print(f"{i}. {doc.page_content[:200]}...")

print("\nOriginal Vector Search Answer:")

print(original_vector_answer)

print("\n" + "-"*50)

print("\nContextualized Vector Search Results:")

for i, doc in enumerate(contextualized_vector_results, 1):

print(f"{i}. {doc.page_content[:200]}...")

print("\nContextualized Vector Search Answer:")

print(contextualized_vector_answer)

print("\n" + "-"*50)

print("\nOriginal BM25 Search Results:")

for i, doc in enumerate(original_bm25_results, 1):

print(f"{i}. {doc.page_content[:200]}...")

print("\nOriginal BM25 Search Answer:")

print(original_bm25_answer)

print("\n" + "-"*50)

print("\nContextualized BM25 Search Results:")

for i, doc in enumerate(contextualized_bm25_results, 1):

print(f"{i}. {doc.page_content[:200]}...")

print("\nContextualized BM25 Search Answer:")

print(contextualized_bm25_answer)

print("\nOriginal Reranker Search Results:")

for i, doc in enumerate(original_reranker_results, 1):

print(f"{i}. {doc.page_content[:200]}...")

print("\nOriginal Reranker Search Answer:")

print(original_reranker_answer)

print("\nContextualized Reranker Search Results:")

for i, doc in enumerate(contextualized_reranker_results, 1):

print(f"{i}. {doc.page_content[:200]}...")

print("\nContextualized Reranker Search Answer:")

print(contextualized_reranker_answer)

print("\nOriginal Ensemble Retriever Reranker Search Results:")

for i, doc in enumerate(original_ensemble_retriever_reranker_results, 1):

print(f"{i}. {doc.page_content[:200]}...")

print("\nOriginal Ensemble Retriever Reranker Search Answer:")

print(original_ensemble_retriever_reranker_answer)

print("\nContextualized Ensemble Retriever Reranker Search Results:")

for i, doc in enumerate(contextualized_ensemble_retriever_reranker_results, 1):

print(f"{i}. {doc.page_content[:200]}...")

print("\nContextualized Ensemble Retriever Reranker Search Answer:")

print(contextualized_ensemble_retriever_reranker_answer)

print("\n" + "="*50)

#####################RESPONSE##################################

Query: What was Tesla's total revenue in Q3 2023? what was the gross profit and cash position?

Original Vector Search Results:

1. Profitability:

Gross profit for Q3 2023 stood at $4.18 billion, with a gross margin of 17.9%. While this represents a decrease from the 25.1% gross margin in Q3 2022, it remains above industry ave...

2. 1. Financial Performance Overview:

Revenue:

Tesla reported total revenue of $23.35 billion in Q3 2023, marking a 9% increase year-over-year (YoY) from $21.45 billion in Q3 2022. The automotiv...

3. Conclusion:

Tesla's Q3 2023 financial results demonstrate the company's continued leadership in the EV market, with strong revenue growth and operational improvements. While facing increased compe...

Original Vector Search Answer:

Based on the provided information, here are the answers to the question:

1. Total revenue in Q3 2023: $23.35 billion

2. Gross profit in Q3 2023: $4.18 billion

3. Cash position in Q3 2023: $26.08 billion

--------------------------------------------------

Contextualized Vector Search Results:

1. Tesla's Q3 2023 financial performance, specifically its profitability, cash flow, and liquidity, demonstrate the company's ability to maintain a strong financial position despite increased competition...

2. Tesla's Q3 2023 financial performance overview, which includes a 9% year-over-year increase in revenue to $23.35 billion, driven by strong growth in the automotive segment and significant increases in...

3. Tesla's Q3 2023 financial report highlights the company's strong revenue growth, with total revenue increasing by 9% year-over-year to $23.35 billion. The automotive segment remains the primary revenu...

Contextualized Vector Search Answer:

Based on the provided information, here are the answers to the questions:

1. What was Tesla's total revenue in Q3 2023?

Tesla's total revenue in Q3 2023 was $23.35 billion.

2. What was the gross profit and cash position?

- Gross profit: $4.18 billion

- Gross margin: 17.9%

- Cash and cash equivalents: $26.08 billion

--------------------------------------------------

Original BM25 Search Results:

1. Profitability:

Gross profit for Q3 2023 stood at $4.18 billion, with a gross margin of 17.9%. While this represents a decrease from the 25.1% gross margin in Q3 2022, it remains above industry ave...

2. 1. Financial Performance Overview:

Revenue:

Tesla reported total revenue of $23.35 billion in Q3 2023, marking a 9% increase year-over-year (YoY) from $21.45 billion in Q3 2022. The automotiv...

3. Conclusion:

Tesla's Q3 2023 financial results demonstrate the company's continued leadership in the EV market, with strong revenue growth and operational improvements. While facing increased compe...

Original BM25 Search Answer:

Based on the provided information, here are the answers to the question:

1. Total revenue in Q3 2023: $23.35 billion

2. Gross profit in Q3 2023: $4.18 billion

3. Cash position in Q3 2023: $26.08 billion

--------------------------------------------------

Contextualized BM25 Search Results:

1. Tesla's Q3 2023 financial performance, specifically its profitability, cash flow, and liquidity, demonstrate the company's ability to maintain a strong financial position despite increased competition...

2. Tesla's Q3 2023 financial performance overview, which includes a 9% year-over-year increase in revenue to $23.35 billion, driven by strong growth in the automotive segment and significant increases in...

3. Tesla's financial performance and market position are evaluated through various metrics, including profitability ratios, liquidity ratios, and efficiency ratios, which provide insights into the compan...

Contextualized BM25 Search Answer:

Based on the provided information, here are the answers to the question:

1. Total revenue in Q3 2023: $23.35 billion

2. Gross profit in Q3 2023: $4.18 billion

3. Gross margin in Q3 2023: 17.9%

The information does not provide the exact cash position, but it does mention that Tesla's cash and cash equivalents at the end of Q3 2023 were $26.08 billion.

Original Reranker Search Results:

1. Conclusion:

Tesla's Q3 2023 financial results demonstrate the company's continued leadership in the EV market, with strong revenue growth and operational improvements. While facing increased compe...

2. 1. Financial Performance Overview:

Revenue:

Tesla reported total revenue of $23.35 billion in Q3 2023, marking a 9% increase year-over-year (YoY) from $21.45 billion in Q3 2022. The automotiv...

3. Profitability:

Gross profit for Q3 2023 stood at $4.18 billion, with a gross margin of 17.9%. While this represents a decrease from the 25.1% gross margin in Q3 2022, it remains above industry ave...

Original Reranker Search Answer:

Based on the provided information, here are the answers to the questions:

1. What was Tesla's total revenue in Q3 2023?

Tesla's total revenue in Q3 2023 was $23.35 billion.

2. What was the gross profit and cash position?

Gross profit for Q3 2023 was $4.18 billion.

Cash and cash equivalents at the end of Q3 2023 were $26.08 billion.

Contextualized Reranker Search Results:

1. Tesla's financial performance and market position are evaluated through various metrics, including profitability ratios, liquidity ratios, and efficiency ratios, which provide insights into the compan...

2. Tesla's Q3 2023 financial performance overview, which includes a 9% year-over-year increase in revenue to $23.35 billion, driven by strong growth in the automotive segment and significant increases in...

3. Tesla's Q3 2023 financial performance, specifically its profitability, cash flow, and liquidity, demonstrate the company's ability to maintain a strong financial position despite increased competition...

Contextualized Reranker Search Answer:

Based on the provided information, here are the answers to the questions:

1. What was Tesla's total revenue in Q3 2023?

Tesla's total revenue in Q3 2023 was $23.35 billion.

2. What was the gross profit and cash position?

- Gross profit: $4.18 billion

- Cash position: $26.08 billion (cash and cash equivalents)

Original Ensemble Retriever Reranker Search Results:

1. Conclusion:

Tesla's Q3 2023 financial results demonstrate the company's continued leadership in the EV market, with strong revenue growth and operational improvements. While facing increased compe...

2. 1. Financial Performance Overview:

Revenue:

Tesla reported total revenue of $23.35 billion in Q3 2023, marking a 9% increase year-over-year (YoY) from $21.45 billion in Q3 2022. The automotiv...

3. Profitability:

Gross profit for Q3 2023 stood at $4.18 billion, with a gross margin of 17.9%. While this represents a decrease from the 25.1% gross margin in Q3 2022, it remains above industry ave...

Original Ensemble Retriever Reranker Search Answer:

Based on the provided information, here are the answers to the questions:

1. What was Tesla's total revenue in Q3 2023?

Tesla's total revenue in Q3 2023 was $23.35 billion.

2. What was the gross profit and cash position?

Gross profit for Q3 2023 was $4.18 billion.

Cash and cash equivalents at the end of Q3 2023 were $26.08 billion.

Contextualized Ensemble Retriever Reranker Search Results:

1. Tesla's financial performance and market position are evaluated through various metrics, including profitability ratios, liquidity ratios, and efficiency ratios, which provide insights into the compan...

2. Tesla's Q3 2023 financial performance overview, which includes a 9% year-over-year increase in revenue to $23.35 billion, driven by strong growth in the automotive segment and significant increases in...

3. Tesla's Q3 2023 financial performance, specifically its profitability, cash flow, and liquidity, demonstrate the company's ability to maintain a strong financial position despite increased competition...

Contextualized Ensemble Retriever Reranker Search Answer:

Based on the provided information, here are the answers to the questions:

1. What was Tesla's total revenue in Q3 2023?

Tesla's total revenue in Q3 2023 was $23.35 billion.

2. What was the gross profit and cash position?

- Gross profit: $4.18 billion

- Cash position: $26.08 billion (cash and cash equivalents)

==================================================

Query: How does the automotive gross margin in Q3 2023 compare to the previous year?

Original Vector Search Results:

1. Profitability:

Gross profit for Q3 2023 stood at $4.18 billion, with a gross margin of 17.9%. While this represents a decrease from the 25.1% gross margin in Q3 2022, it remains above industry ave...

2. Conclusion:

Tesla's Q3 2023 financial results demonstrate the company's continued leadership in the EV market, with strong revenue growth and operational improvements. While facing increased compe...

3. Liquidity Ratios:

- Current Ratio: 1.73

- Quick Ratio: 1.25

Efficiency Ratios:

- Asset Turnover Ratio: 0.88

- Inventory Turnover Ratio: 11.2

Valuation Metrics:

- Price-to...

Original Vector Search Answer:

The information provided is not sufficient to answer the question of how the automotive gross margin in Q3 2023 compares to the previous year. The relevant information for the automotive segment is only the gross margin for Q3 2023, which is 18.9%, but there is no information comparing this to the gross margin in Q3 2022.

--------------------------------------------------

Contextualized Vector Search Results:

1. Tesla's Q3 2023 financial performance, specifically its profitability, cash flow, and liquidity, demonstrate the company's ability to maintain a strong financial position despite increased competition...

2. Tesla's Q3 2023 financial performance overview, which includes a 9% year-over-year increase in revenue to $23.35 billion, driven by strong growth in the automotive segment and significant increases in...

3. Tesla's Q3 2023 financial results demonstrate the company's continued leadership in the EV market, with strong revenue growth and operational improvements. The conclusion highlights Tesla's robust bal...

Contextualized Vector Search Answer:

The information provided is not sufficient to answer the question of how the automotive gross margin in Q3 2023 compares to the previous year. The relevant information only mentions the gross margin for Q3 2023 as 17.9%, but does not provide a comparison to the gross margin in Q3 2022.

--------------------------------------------------

Original BM25 Search Results:

1. Profitability:

Gross profit for Q3 2023 stood at $4.18 billion, with a gross margin of 17.9%. While this represents a decrease from the 25.1% gross margin in Q3 2022, it remains above industry ave...

2. Conclusion:

Tesla's Q3 2023 financial results demonstrate the company's continued leadership in the EV market, with strong revenue growth and operational improvements. While facing increased compe...

3. Expansion Plans:

Plans for a new Gigafactory in Mexico are progressing, with production expected to commence in 2025. This facility will focus on producing Tesla's next-generation vehicles and exp...

Original BM25 Search Answer:

The information provided is not sufficient to answer the question of how the automotive gross margin in Q3 2023 compares to the previous year. The relevant information only mentions the gross margin for Q3 2023 as 17.9%, but does not provide a comparison to the gross margin in Q3 2022.

--------------------------------------------------

Contextualized BM25 Search Results:

1. Tesla's Q3 2023 financial performance, specifically its profitability, cash flow, and liquidity, demonstrate the company's ability to maintain a strong financial position despite increased competition...

2. Tesla's Q3 2023 financial performance overview, which includes a 9% year-over-year increase in revenue to $23.35 billion, driven by strong growth in the automotive segment and significant increases in...

3. Tesla's Q3 2023 financial results demonstrate the company's continued leadership in the EV market, with strong revenue growth and operational improvements. The conclusion highlights Tesla's robust bal...

Contextualized BM25 Search Answer:

The information provided is not sufficient to answer the question of how the automotive gross margin in Q3 2023 compares to the previous year. The relevant information only mentions the gross margin for Q3 2023 as 17.9%, but does not provide a comparison to the gross margin in Q3 2022.

Original Reranker Search Results:

1. Profitability:

Gross profit for Q3 2023 stood at $4.18 billion, with a gross margin of 17.9%. While this represents a decrease from the 25.1% gross margin in Q3 2022, it remains above industry ave...

2. Conclusion:

Tesla's Q3 2023 financial results demonstrate the company's continued leadership in the EV market, with strong revenue growth and operational improvements. While facing increased compe...

3. 1. Financial Performance Overview:

Revenue:

Tesla reported total revenue of $23.35 billion in Q3 2023, marking a 9% increase year-over-year (YoY) from $21.45 billion in Q3 2022. The automotiv...

Original Reranker Search Answer:

The information provided is not sufficient to answer the question of how the automotive gross margin in Q3 2023 compares to the previous year. The relevant information about the automotive segment's revenue is given, but there is no information about the gross margin.

Contextualized Reranker Search Results:

1. Tesla's Q3 2023 financial performance overview, which includes a 9% year-over-year increase in revenue to $23.35 billion, driven by strong growth in the automotive segment and significant increases in...

2. Tesla's financial performance and market position are evaluated through various metrics, including profitability ratios, liquidity ratios, and efficiency ratios, which provide insights into the compan...

3. Tesla's Q3 2023 financial report highlights the company's strong revenue growth, with total revenue increasing by 9% year-over-year to $23.35 billion. The automotive segment remains the primary revenu...

Contextualized Reranker Search Answer:

The information provided is not sufficient to answer the question of how the automotive gross margin in Q3 2023 compares to the previous year. The text mentions the gross margin for Q3 2023 as 17.9%, but it does not provide the gross margin for Q3 2022 to make a comparison.

Original Ensemble Retriever Reranker Search Results:

1. Profitability:

Gross profit for Q3 2023 stood at $4.18 billion, with a gross margin of 17.9%. While this represents a decrease from the 25.1% gross margin in Q3 2022, it remains above industry ave...

2. Conclusion:

Tesla's Q3 2023 financial results demonstrate the company's continued leadership in the EV market, with strong revenue growth and operational improvements. While facing increased compe...

3. 1. Financial Performance Overview:

Revenue:

Tesla reported total revenue of $23.35 billion in Q3 2023, marking a 9% increase year-over-year (YoY) from $21.45 billion in Q3 2022. The automotiv...

Original Ensemble Retriever Reranker Search Answer:

The information provided is not sufficient to answer the question of how the automotive gross margin in Q3 2023 compares to the previous year. The relevant information about the automotive segment's revenue is given, but there is no information about the gross margin.

Contextualized Ensemble Retriever Reranker Search Results:

1. Tesla's Q3 2023 financial performance overview, which includes a 9% year-over-year increase in revenue to $23.35 billion, driven by strong growth in the automotive segment and significant increases in...

2. Tesla's financial performance and market position are evaluated through various metrics, including profitability ratios, liquidity ratios, and efficiency ratios, which provide insights into the compan...

3. Tesla's Q3 2023 financial report highlights the company's strong revenue growth, with total revenue increasing by 9% year-over-year to $23.35 billion. The automotive segment remains the primary revenu...

Contextualized Ensemble Retriever Reranker Search Answer:

The information provided is not sufficient to answer the question of how the automotive gross margin in Q3 2023 compares to the previous year. The text mentions the gross margin for Q3 2023 as 17.9%, but it does not provide the gross margin for Q3 2022 to make a comparison.

==================================================

Query: What is Tesla's current debt-to-equity ratio?

Original Vector Search Results:

1. 11. Debt and Capital Structure:

As of September 30, 2023:

- Total Debt: $5.62 billion

- Total Equity: $43.51 billion

- Debt-to-Equity Ratio: 0.13

- Weighted Average Cost of Capita...

2. Liquidity Ratios:

- Current Ratio: 1.73

- Quick Ratio: 1.25

Efficiency Ratios:

- Asset Turnover Ratio: 0.88

- Inventory Turnover Ratio: 11.2

Valuation Metrics:

- Price-to...

3. Regulatory Environment:

Evolving regulations around EVs, autonomous driving, and data privacy across different markets could impact Tesla's operations and expansion plans.

Macroeconomic Facto...

Original Vector Search Answer:

The information provided is not sufficient to answer the question about Tesla's current debt-to-equity ratio. The relevant information about the debt-to-equity ratio is from 2023, but the question does not specify the current year or quarter.

--------------------------------------------------

Contextualized Vector Search Results:

1. Tesla's debt and capital structure, including total debt, total equity, debt-to-equity ratio, and weighted average cost of capital (WACC), are presented as of September 30, 2023, providing insight int...

2. Tesla's financial performance and segment analysis reveal strong revenue growth, with the automotive segment contributing 84% of total revenue and energy generation and storage revenue increasing by 4...

3. Tesla's financial performance and market position are evaluated through various metrics, including profitability ratios, liquidity ratios, and efficiency ratios, which provide insights into the compan...

Contextualized Vector Search Answer:

The information provided is not sufficient to answer the question about Tesla's current debt-to-equity ratio. The relevant information about the debt-to-equity ratio is presented as of September 30, 2023, but it is not explicitly stated that this information is current or up-to-date.

--------------------------------------------------

Original BM25 Search Results:

1. Energy Business:

Tesla's energy storage deployments grew by 90% YoY, reaching 4.0 GWh in Q3 2023. Solar deployments also increased by 48% YoY to 106 MW, reflecting growing demand for Tesla's energ...

2. Conclusion:

Tesla's Q3 2023 financial results demonstrate the company's continued leadership in the EV market, with strong revenue growth and operational improvements. While facing increased compe...

3. Regulatory Environment:

Evolving regulations around EVs, autonomous driving, and data privacy across different markets could impact Tesla's operations and expansion plans.

Macroeconomic Facto...

Original BM25 Search Answer:

The information provided is not sufficient to answer the question about Tesla's current debt-to-equity ratio. The relevant financial ratios mentioned in the text are Return on Equity (ROE), Return on Assets (ROA), EBITDA Margin, Current Ratio, and Quick Ratio, but the debt-to-equity ratio is not mentioned or calculated in the given information.

--------------------------------------------------

Contextualized BM25 Search Results:

1. Tesla's debt and capital structure, including total debt, total equity, debt-to-equity ratio, and weighted average cost of capital (WACC), are presented as of September 30, 2023, providing insight int...

2. Tesla's financial performance and segment analysis reveal strong revenue growth, with the automotive segment contributing 84% of total revenue and energy generation and storage revenue increasing by 4...

3. Tesla's energy business segment is highlighted, with significant growth in energy storage deployments (90% YoY) and solar deployments (48% YoY) in Q3 2023. This growth reflects increasing demand for T...

Contextualized BM25 Search Answer:

The information provided is not sufficient to answer the question about Tesla's current debt-to-equity ratio. The relevant information about the debt-to-equity ratio is presented as of September 30, 2023, but it is not explicitly stated that this information is current or up-to-date.

Original Reranker Search Results:

1. Technology Leadership:

The company's focus on innovation, particularly in battery technology and autonomous driving capabilities, remains a key differentiator. Tesla's Full Self-Driving (FSD) beta...

2. Liquidity Ratios:

- Current Ratio: 1.73

- Quick Ratio: 1.25

Efficiency Ratios:

- Asset Turnover Ratio: 0.88

- Inventory Turnover Ratio: 11.2

Valuation Metrics:

- Price-to...

3. Regulatory Environment:

Evolving regulations around EVs, autonomous driving, and data privacy across different markets could impact Tesla's operations and expansion plans.

Macroeconomic Facto...

Original Reranker Search Answer:

The information provided is not sufficient to answer the question about Tesla's current debt-to-equity ratio. The relevant financial ratios mentioned in the text include the Current Ratio, Quick Ratio, Asset Turnover Ratio, Inventory Turnover Ratio, Price-to-Earnings (P/E) Ratio, Price-to-Sales (P/S) Ratio, Enterprise Value to EBITDA (EV/EBITDA), Return on Equity (ROE), Return on Assets (ROA), and EBITDA Margin, but none of these ratios directly provide information about the debt-to-equity ratio.

Contextualized Reranker Search Results:

1. Tesla's debt and capital structure, including total debt, total equity, debt-to-equity ratio, and weighted average cost of capital (WACC), are presented as of September 30, 2023, providing insight int...

2. Tesla's financial performance and segment analysis reveal strong revenue growth, with the automotive segment contributing 84% of total revenue and energy generation and storage revenue increasing by 4...

3. Tesla's financial performance and market position are evaluated through various metrics, including profitability ratios, liquidity ratios, and efficiency ratios, which provide insights into the compan...

Contextualized Reranker Search Answer:

The information provided is not sufficient to answer the question about Tesla's current debt-to-equity ratio. The relevant information about the debt-to-equity ratio is presented as of September 30, 2023, but it is not explicitly stated that this information is current or up-to-date.

Original Ensemble Retriever Reranker Search Results:

1. Technology Leadership:

The company's focus on innovation, particularly in battery technology and autonomous driving capabilities, remains a key differentiator. Tesla's Full Self-Driving (FSD) beta...

2. Liquidity Ratios:

- Current Ratio: 1.73

- Quick Ratio: 1.25

Efficiency Ratios:

- Asset Turnover Ratio: 0.88

- Inventory Turnover Ratio: 11.2

Valuation Metrics:

- Price-to...

3. Regulatory Environment:

Evolving regulations around EVs, autonomous driving, and data privacy across different markets could impact Tesla's operations and expansion plans.

Macroeconomic Facto...

Original Ensemble Retriever Reranker Search Answer:

The information provided is not sufficient to answer the question about Tesla's current debt-to-equity ratio. The relevant financial ratios mentioned in the text include the Current Ratio, Quick Ratio, Asset Turnover Ratio, Inventory Turnover Ratio, Price-to-Earnings (P/E) Ratio, Price-to-Sales (P/S) Ratio, Enterprise Value to EBITDA (EV/EBITDA), Return on Equity (ROE), Return on Assets (ROA), and EBITDA Margin, but none of these ratios directly provide information about the debt-to-equity ratio.

Contextualized Ensemble Retriever Reranker Search Results:

1. Tesla's debt and capital structure, including total debt, total equity, debt-to-equity ratio, and weighted average cost of capital (WACC), are presented as of September 30, 2023, providing insight int...

2. Tesla's financial performance and segment analysis reveal strong revenue growth, with the automotive segment contributing 84% of total revenue and energy generation and storage revenue increasing by 4...

3. Tesla's financial performance and market position are evaluated through various metrics, including profitability ratios, liquidity ratios, and efficiency ratios, which provide insights into the compan...

Contextualized Ensemble Retriever Reranker Search Answer:

The information provided is not sufficient to answer the question about Tesla's current debt-to-equity ratio. The relevant information about the debt-to-equity ratio is presented as of September 30, 2023, but it is not explicitly stated that this information is current or up-to-date.

==================================================

Query: How much did Tesla invest in R&D during Q3 2023?

Original Vector Search Results:

1. 9. Research and Development:

Tesla invested $1.16 billion in R&D during Q3 2023, representing 5% of total revenue. Key focus areas include:

- Next-generation vehicle platform development

...

2. Conclusion:

Tesla's Q3 2023 financial results demonstrate the company's continued leadership in the EV market, with strong revenue growth and operational improvements. While facing increased compe...

3. 1. Financial Performance Overview:

Revenue:

Tesla reported total revenue of $23.35 billion in Q3 2023, marking a 9% increase year-over-year (YoY) from $21.45 billion in Q3 2022. The automotiv...

Original Vector Search Answer:

Tesla invested $1.16 billion in R&D during Q3 2023, representing 5% of total revenue.

--------------------------------------------------

Contextualized Vector Search Results:

1. Tesla's research and development investments and capital expenditures are crucial for the company's future growth, with a focus on next-generation vehicle platforms, battery technology advancements, a...

2. Tesla's Q3 2023 financial results demonstrate the company's continued leadership in the EV market, with strong revenue growth and operational improvements. The conclusion highlights Tesla's robust bal...

3. Tesla's Q3 2023 financial report highlights the company's strong revenue growth, with total revenue increasing by 9% year-over-year to $23.35 billion. The automotive segment remains the primary revenu...

Contextualized Vector Search Answer:

According to the provided information, Tesla invested $1.16 billion in Research and Development (R&D) during Q3 2023, representing 5% of total revenue.

--------------------------------------------------

Original BM25 Search Results:

1. 9. Research and Development:

Tesla invested $1.16 billion in R&D during Q3 2023, representing 5% of total revenue. Key focus areas include:

- Next-generation vehicle platform development

...

2. 1. Financial Performance Overview:

Revenue:

Tesla reported total revenue of $23.35 billion in Q3 2023, marking a 9% increase year-over-year (YoY) from $21.45 billion in Q3 2022. The automotiv...

3. Energy Business:

Tesla's energy storage deployments grew by 90% YoY, reaching 4.0 GWh in Q3 2023. Solar deployments also increased by 48% YoY to 106 MW, reflecting growing demand for Tesla's energ...

Original BM25 Search Answer:

According to the provided information, Tesla invested $1.16 billion in Research and Development (R&D) during Q3 2023, representing 5% of total revenue.

--------------------------------------------------

Contextualized BM25 Search Results:

1. Tesla's research and development investments and capital expenditures are crucial for the company's future growth, with a focus on next-generation vehicle platforms, battery technology advancements, a...

2. Tesla's debt and capital structure, including total debt, total equity, debt-to-equity ratio, and weighted average cost of capital (WACC), are presented as of September 30, 2023, providing insight int...

3. Tesla's energy business segment is highlighted, with significant growth in energy storage deployments (90% YoY) and solar deployments (48% YoY) in Q3 2023. This growth reflects increasing demand for T...

Contextualized BM25 Search Answer:

According to the provided information, Tesla invested $1.16 billion in Research and Development (R&D) during Q3 2023, representing 5% of total revenue.

Original Reranker Search Results:

1. 9. Research and Development:

Tesla invested $1.16 billion in R&D during Q3 2023, representing 5% of total revenue. Key focus areas include:

- Next-generation vehicle platform development

...

2. Conclusion:

Tesla's Q3 2023 financial results demonstrate the company's continued leadership in the EV market, with strong revenue growth and operational improvements. While facing increased compe...

3. 1. Financial Performance Overview:

Revenue:

Tesla reported total revenue of $23.35 billion in Q3 2023, marking a 9% increase year-over-year (YoY) from $21.45 billion in Q3 2022. The automotiv...

Original Reranker Search Answer:

Tesla invested $1.16 billion in R&D during Q3 2023, representing 5% of total revenue.

Contextualized Reranker Search Results:

1. Tesla's energy business segment is highlighted, with significant growth in energy storage deployments (90% YoY) and solar deployments (48% YoY) in Q3 2023. This growth reflects increasing demand for T...

2. Tesla's Q3 2023 financial performance, specifically its profitability, cash flow, and liquidity, demonstrate the company's ability to maintain a strong financial position despite increased competition...

3. Tesla's Q3 2023 financial report highlights the company's strong production and delivery performance, with a 17% increase in vehicle production and a 27% YoY increase in deliveries. This chunk specifi...

Contextualized Reranker Search Answer:

The information provided does not mention Tesla's investment in Research and Development (R&D) during Q3 2023. The relevant information focuses on the company's energy business segment, market position, financial performance, and operational highlights, but does not include details on R&D spending.

Original Ensemble Retriever Reranker Search Results:

1. 9. Research and Development:

Tesla invested $1.16 billion in R&D during Q3 2023, representing 5% of total revenue. Key focus areas include:

- Next-generation vehicle platform development

...

2. Conclusion:

Tesla's Q3 2023 financial results demonstrate the company's continued leadership in the EV market, with strong revenue growth and operational improvements. While facing increased compe...

3. 1. Financial Performance Overview:

Revenue:

Tesla reported total revenue of $23.35 billion in Q3 2023, marking a 9% increase year-over-year (YoY) from $21.45 billion in Q3 2022. The automotiv...

Original Ensemble Retriever Reranker Search Answer:

Tesla invested $1.16 billion in R&D during Q3 2023, representing 5% of total revenue.

Contextualized Ensemble Retriever Reranker Search Results:

1. Tesla's energy business segment is highlighted, with significant growth in energy storage deployments (90% YoY) and solar deployments (48% YoY) in Q3 2023. This growth reflects increasing demand for T...

2. Tesla's Q3 2023 financial performance, specifically its profitability, cash flow, and liquidity, demonstrate the company's ability to maintain a strong financial position despite increased competition...

3. Tesla's Q3 2023 financial report highlights the company's strong production and delivery performance, with a 17% increase in vehicle production and a 27% YoY increase in deliveries. This chunk specifi...

Contextualized Ensemble Retriever Reranker Search Answer:

The information provided does not mention Tesla's investment in Research and Development (R&D) during Q3 2023. The relevant information focuses on the company's energy business segment, market position, financial performance, and operational highlights, but does not include details on R&D spending.

==================================================

Query: What is Tesla's market share in the global EV market for Q3 2023?

Original Vector Search Results:

1. Energy Business:

Tesla's energy storage deployments grew by 90% YoY, reaching 4.0 GWh in Q3 2023. Solar deployments also increased by 48% YoY to 106 MW, reflecting growing demand for Tesla's energ...

2. Tesla, Inc. (TSLA) Financial Analysis and Market Overview - Q3 2023

Executive Summary:

Tesla, Inc. (NASDAQ: TSLA) continues to lead the electric vehicle (EV) market, showcasing strong financi...

3. Conclusion:

Tesla's Q3 2023 financial results demonstrate the company's continued leadership in the EV market, with strong revenue growth and operational improvements. While facing increased compe...

Original Vector Search Answer:

The information provided is sufficient to answer the question. According to the relevant information, Tesla's market share in the global EV market for Q3 2023 is estimated to be 18%.

--------------------------------------------------

Contextualized Vector Search Results:

1. Tesla's energy business segment is highlighted, with significant growth in energy storage deployments (90% YoY) and solar deployments (48% YoY) in Q3 2023. This growth reflects increasing demand for T...

2. Tesla's Q3 2023 financial performance overview, which includes a 9% year-over-year increase in revenue to $23.35 billion, driven by strong growth in the automotive segment and significant increases in...

3. Tesla's Q3 2023 financial results demonstrate the company's continued leadership in the EV market, with strong revenue growth and operational improvements. The conclusion highlights Tesla's robust bal...

Contextualized Vector Search Answer:

The information provided is sufficient to answer the question. According to the text, Tesla's estimated global market share in the EV market for Q3 2023 is 18%.

--------------------------------------------------

Original BM25 Search Results:

1. Energy Business:

Tesla's energy storage deployments grew by 90% YoY, reaching 4.0 GWh in Q3 2023. Solar deployments also increased by 48% YoY to 106 MW, reflecting growing demand for Tesla's energ...

2. Regulatory Environment:

Evolving regulations around EVs, autonomous driving, and data privacy across different markets could impact Tesla's operations and expansion plans.

Macroeconomic Facto...

3. Tesla, Inc. (TSLA) Financial Analysis and Market Overview - Q3 2023

Executive Summary:

Tesla, Inc. (NASDAQ: TSLA) continues to lead the electric vehicle (EV) market, showcasing strong financi...

Original BM25 Search Answer:

The information provided is not sufficient to answer the question about Tesla's market share in the global EV market for Q3 2023. The relevant information mentions that Tesla maintained its position as the world's largest EV manufacturer by volume, with an estimated global market share of 18% in Q3 2023, but it does not provide the total global EV market size or any other data that would allow for a more precise calculation of Tesla's market share.

--------------------------------------------------

Contextualized BM25 Search Results:

1. Tesla's energy business segment is highlighted, with significant growth in energy storage deployments (90% YoY) and solar deployments (48% YoY) in Q3 2023. This growth reflects increasing demand for T...

2. Tesla's financial performance and market position are evaluated through various metrics, including profitability ratios, liquidity ratios, and efficiency ratios, which provide insights into the compan...

3. Tesla's Q3 2023 financial performance overview, which includes a 9% year-over-year increase in revenue to $23.35 billion, driven by strong growth in the automotive segment and significant increases in...

Contextualized BM25 Search Answer:

The information provided is sufficient to answer the question. According to the text, Tesla's estimated global market share in the EV market for Q3 2023 is 18%.

Original Reranker Search Results:

1. Conclusion:

Tesla's Q3 2023 financial results demonstrate the company's continued leadership in the EV market, with strong revenue growth and operational improvements. While facing increased compe...

2. Profitability:

Gross profit for Q3 2023 stood at $4.18 billion, with a gross margin of 17.9%. While this represents a decrease from the 25.1% gross margin in Q3 2022, it remains above industry ave...

3. 2. Operational Highlights:

Production and Deliveries:

Tesla produced 430,488 vehicles in Q3 2023, a 17% increase YoY. The Model 3/Y accounted for 419,666 units, while the Model S/X contribute...

Original Reranker Search Answer:

The information provided is not sufficient to answer the question about Tesla's market share in the global EV market for Q3 2023. The text only discusses Tesla's financial results, production and delivery numbers, and manufacturing capacity, but does not provide any data on the global EV market share.

Contextualized Reranker Search Results:

1. Tesla's energy business segment is highlighted, with significant growth in energy storage deployments (90% YoY) and solar deployments (48% YoY) in Q3 2023. This growth reflects increasing demand for T...

2. Tesla's Q3 2023 financial report highlights the company's strong production and delivery performance, with a 17% increase in vehicle production and a 27% YoY increase in deliveries. This chunk specifi...

3. Tesla's Q3 2023 financial report highlights the company's strong revenue growth, with total revenue increasing by 9% year-over-year to $23.35 billion. The automotive segment remains the primary revenu...

Contextualized Reranker Search Answer:

The information provided is sufficient to answer the question. According to the text, Tesla's estimated global market share in the EV market for Q3 2023 is 18%.

Original Ensemble Retriever Reranker Search Results:

1. Conclusion:

Tesla's Q3 2023 financial results demonstrate the company's continued leadership in the EV market, with strong revenue growth and operational improvements. While facing increased compe...

2. Profitability:

Gross profit for Q3 2023 stood at $4.18 billion, with a gross margin of 17.9%. While this represents a decrease from the 25.1% gross margin in Q3 2022, it remains above industry ave...

3. 2. Operational Highlights:

Production and Deliveries:

Tesla produced 430,488 vehicles in Q3 2023, a 17% increase YoY. The Model 3/Y accounted for 419,666 units, while the Model S/X contribute...

Original Ensemble Retriever Reranker Search Answer:

The information provided is not sufficient to answer the question about Tesla's market share in the global EV market for Q3 2023. The text only discusses Tesla's financial results, production and delivery numbers, and manufacturing capacity, but does not provide any data on the global EV market share.

Contextualized Ensemble Retriever Reranker Search Results:

1. Tesla's energy business segment is highlighted, with significant growth in energy storage deployments (90% YoY) and solar deployments (48% YoY) in Q3 2023. This growth reflects increasing demand for T...

2. Tesla's Q3 2023 financial report highlights the company's strong production and delivery performance, with a 17% increase in vehicle production and a 27% YoY increase in deliveries. This chunk specifi...

3. Tesla's Q3 2023 financial report highlights the company's strong revenue growth, with total revenue increasing by 9% year-over-year to $23.35 billion. The automotive segment remains the primary revenu...